Understanding Credit Limits: A Comprehensive Guide to Manage Your Credit Responsibly

Introduction

In the world of personal finance and credit, understanding the concept of a credit limit is essential for responsible financial management. A credit limit is a predetermined amount that a financial institution, such as a credit card issuer or a lender, sets as the maximum borrowing threshold for an individual or a business. It serves as a crucial factor in determining a borrower's creditworthiness and managing their overall debt.

This comprehensive guide will delve into the intricacies of credit limits, how they work, their impact on your credit score, and strategies to manage them responsibly. Whether you're new to credit or looking to improve your financial well-being, this article will equip you with valuable insights to navigate the world of credit limits effectively.

What is a Credit Limit?

A credit limit, often referred to as a credit line, is the maximum amount of money a lender or credit card issuer allows you to borrow on a revolving credit account. It represents the upper boundary of your borrowing capacity and is determined by various factors, including your credit history, income, employment status, and overall creditworthiness.

Credit limits are common features of credit cards, lines of credit, and personal loans. They are designed to manage risk for lenders while providing borrowers with a measure of financial flexibility.

YOU MAY LIKE THIS

What is a credit card penalty APR?

How can I consolidate credit card debt?

How Does a Credit Limit Work?

Credit Card Credit Limits: For credit cards, the credit limit is the total amount of money you can charge to your card. It is not a fixed amount and can change over time based on your credit behaviour and the issuer's policies. When you make purchases with your credit card, the available credit decreases, and when you repay the outstanding balance, the available credit increases again, up to the credit limit.

Line of Credit Credit Limits: In the case of a line of credit, the credit limit works similarly to a credit card. It is a present amount, and you can borrow from the line of credit as needed, up to the maximum limit. As you repay the borrowed amount, your available credit is replenished, allowing you to borrow again.

Personal Loan Credit Limits: Unlike credit cards and lines of credit, personal loans have fixed credit limits. When you apply for a personal loan, the lender approves a specific loan amount, and you receive the full amount upfront. You repay the loan in instalments over a predetermined period.

Factors That Influence Your Credit Limit

Several key factors determine the credit limit set by lenders or credit card issuers:

a. Credit History: Your credit history plays a significant role in determining your creditworthiness. Lenders will review your credit report to assess your payment history, credit utilization, length of credit history, and any negative marks, such as late payments or defaults.

b. Income and Employment Status: Lenders want to ensure that you have the financial means to repay the credit they extend to you. Your income level and stable employment status are critical factors in determining your credit limit.

c. Credit Utilization Ratio: The credit utilization ratio is the percentage of your available credit that you are currently using. Lenders prefer to see a low credit utilization ratio, typically below 30%. A lower utilization ratio demonstrates responsible credit management and can positively impact your credit limit.

d. Debt-to-Income Ratio: Your debt-to-income ratio compares your monthly debt payments to your monthly income. A lower ratio signifies better financial health and may lead to a higher credit limit.

e. Relationship with the Lender: Existing customers who have a positive relationship with a lender may be eligible for higher credit limits over time. This is especially true for credit card issuers who may increase your limit based on your responsible credit usage.

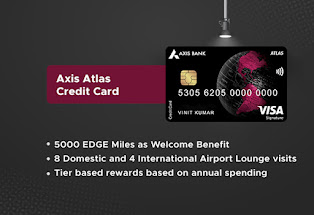

|

| Premium travel card offering EDGE Miles, airport lounge access and other travel benefits! |

The Impact of Credit Limits on Your Credit Score

Your credit limit has a direct impact on your credit score, which is a numerical representation of your creditworthiness. Understanding this relationship is crucial for maintaining a healthy credit score:

a. Credit Utilization: As mentioned earlier, your credit utilization ratio is a significant factor in credit scoring models. A lower credit utilization ratio indicates responsible credit usage and can positively influence your credit score. On the other hand, maxing out your credit cards and using a high percentage of your available credit can have a negative impact on your score.

b. New Credit Applications: Applying for new credit can result in hard inquiries on your credit report, which may cause a temporary dip in your credit score. When you apply for a new credit card or loan, lenders may review your creditworthiness, including your credit limit and overall borrowing capacity.

c. Credit Age: The length of your credit history also affects your credit score. Closing an old credit card account with a high credit limit could shorten your credit history, potentially lowering your credit score.

Responsible Credit Limit Management

Effectively managing your credit limit is crucial for maintaining a healthy financial profile and maximizing your credit score. Here are some strategies to help you responsibly handle your credit limits:

a. Monitor Credit Utilization: Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit management. Regularly monitor your credit card balances and make timely payments to maintain a healthy utilization rate.

b. Avoid Maxing Out Credit Cards: Maxing out your credit cards can harm your credit score and increase the risk of missing payments. Try to use your credit cards sparingly and pay off the balances in full each month.

c. Request Credit Limit Increases Wisely: If you have been a responsible borrower, you may consider requesting a credit limit increase. However, avoid making multiple requests within a short period, as this could raise concerns among lenders about your financial stability.

d. Pay Bills on Time: Timely bill payments are crucial for maintaining a positive credit history. Set up reminders or automatic payments to ensure you never miss a due date.

e. Review Your Credit Report: Regularly review your credit report to check for inaccuracies or fraudulent activities. Dispute any errors you find to keep your credit history accurate and up-to-date.

RECOMMENDED POST

Can I use my credit card for online gambling transactions?

What is a credit card default rate?

Conclusion

Understanding and effectively managing your credit limits is an essential part of maintaining a healthy financial life. A credit limit represents the maximum amount you can borrow from a lender or credit card issuer. It is influenced by various factors, including your credit history, income, and creditworthiness. Responsible credit limit management involves maintaining a low credit utilization ratio, making timely payments, and avoiding excessive debt.

By following the strategies outlined in this comprehensive guide, you can navigate the world of credit limits wisely and build a strong foundation for a positive credit score and financial future. Remember, responsible credit usage is a key pillar of financial success, and staying informed about your credit limits will help you achieve your long-term financial goals.

ARTICLE RELATED TO :-

credit limits, credit limit, credit card limit, card credit limit, what is credit limit, what is a credit limit, credit limit definition, is credit limit monthly, is a credit limit monthly, what is my credit limit, limit credit,

*******************************************

*******************************************

FAQ

What is the meaning of credit limit?

The credit limit is the maximum amount of money a credit card issuer allows a cardholder to borrow on a revolving credit account. It represents the cap on the total outstanding balance a cardholder can carry at any given time. The credit limit is determined by various factors, including the individual's creditworthiness, income, and financial history. Responsible use of credit within this limit can positively impact credit scores, while exceeding it may lead to penalties, fees, and potential damage to one's credit profile. Understanding and managing the credit limit is essential for maintaining financial health and responsible credit card usage.

Is having a 1000 credit limit good?

A $1000 credit limit can be beneficial for certain individuals, especially those establishing or rebuilding credit. It provides a moderate spending capacity while minimizing the risk of accumulating excessive debt. For responsible users, a lower limit encourages disciplined spending and timely repayments, contributing positively to credit scores. However, the adequacy of a $1000 limit depends on personal financial needs. Some may find it restrictive, while others view it as a manageable tool for controlled credit usage. It's crucial to align the credit limit with individual financial goals, ensuring it promotes responsible borrowing and supports overall financial well-being.

Is a credit limit monthly?

A credit limit is not a monthly restriction but rather a cap on the total amount a credit card issuer allows a cardholder to borrow at any given time. This limit remains constant throughout the billing cycle, and users can make purchases or incur charges up to that predefined amount. The credit card company reassesses the credit limit periodically based on the cardholder's creditworthiness and financial behavior. While the credit limit itself doesn't renew monthly, cardholders must manage their spending within this limit and make timely payments to maintain a positive credit relationship with the issuer.

*******************************************

VIDEO TUTORIALS

What are Credit Limits in Credit Card? •Cash limit •Credit Limit•Available Limit

Credit Card Limit Increase Trap | Credit Card Loan Scam | Financial Awareness

How to Increase #Cibil Score Instantly? | Credit Score Kaise Badhaye | #CreditCard & Loans

.gif)